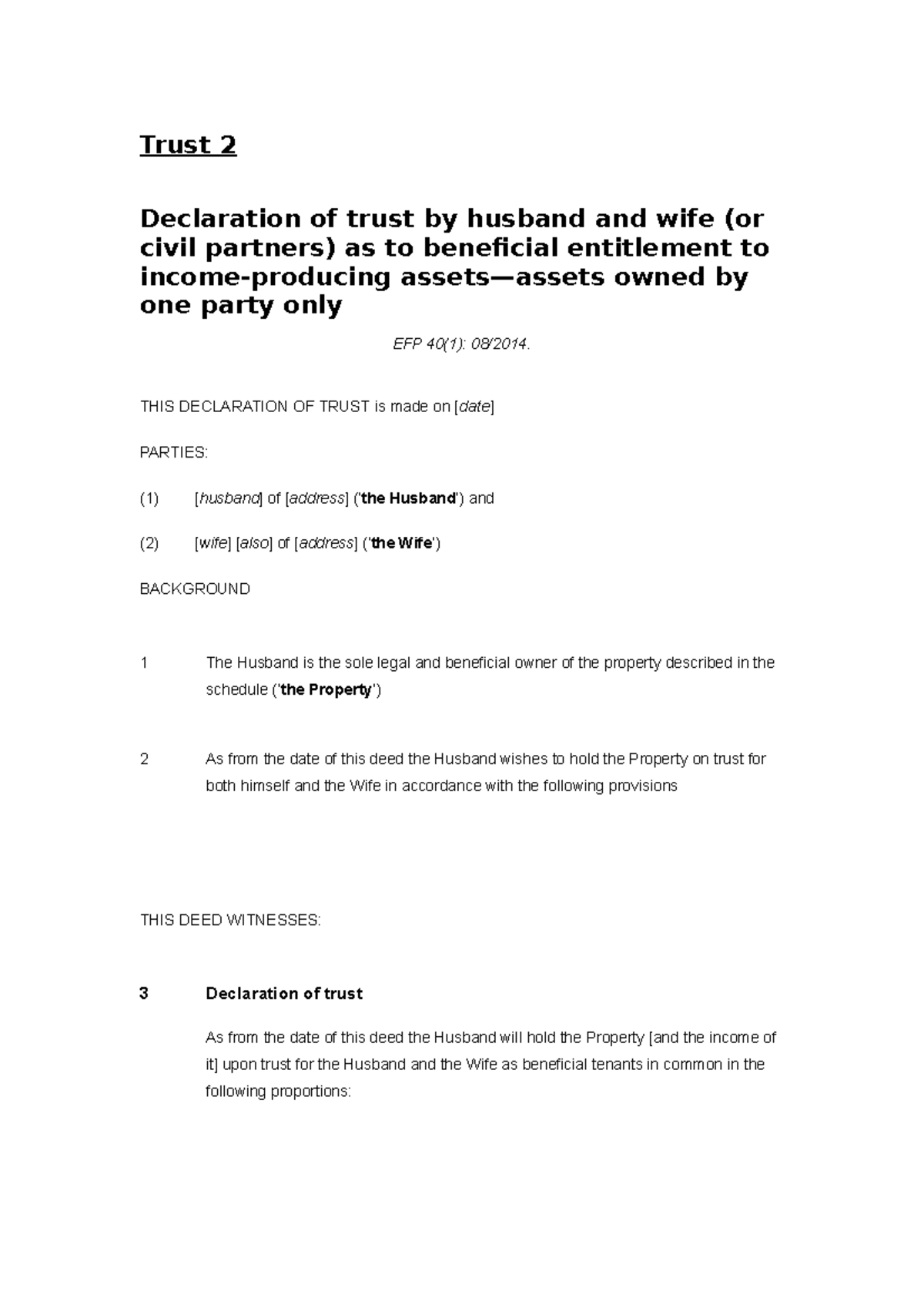

Step 3: I will provide a copy of the declaration to my accountant for their records. Step 4: In accordance with the declaration, my accountant will declare 100% of the rental income under my wife's self-assessment return, as she will be the designated recipient of the rental income, despite my ownership of the property.. Optimising property income. A Declaration of Trust can be used when you are looking to optimise the income you receive from a rental property. Consider the example where a couple jointly own a rental property but have different levels of income. Spouse A is a higher rate taxpayer, whilst the other (spouse B) has a lower income well within their.

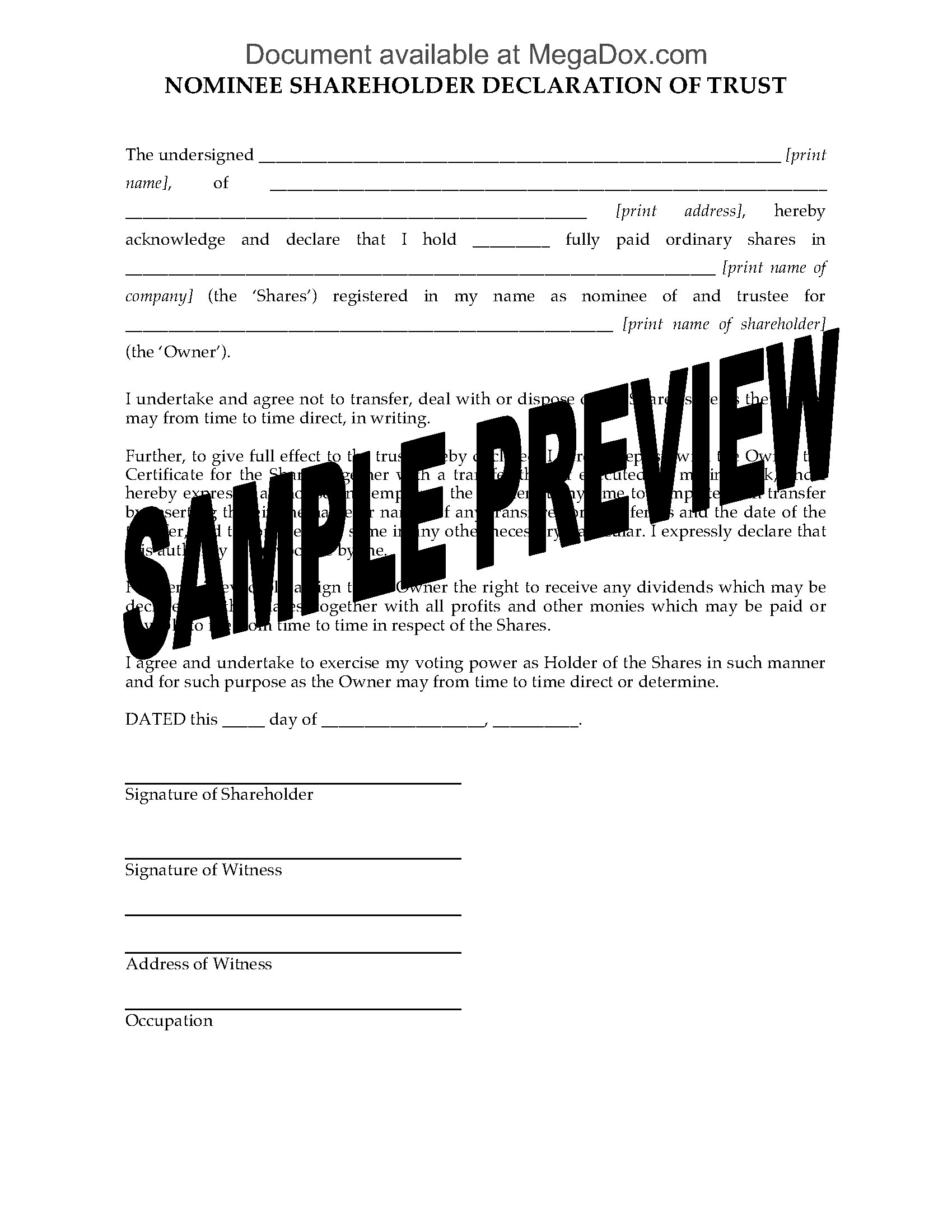

UK Trust Declaration by Nominee Trustee Legal Forms and Business Templates

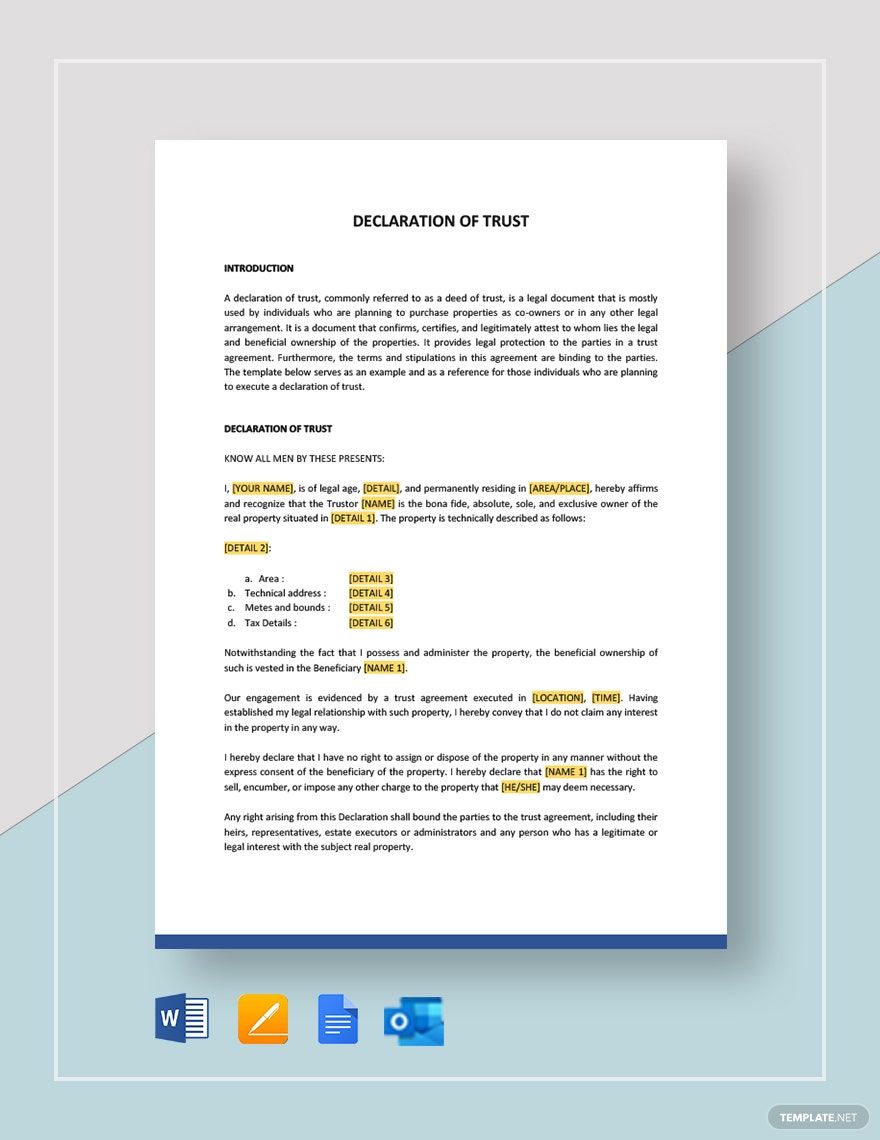

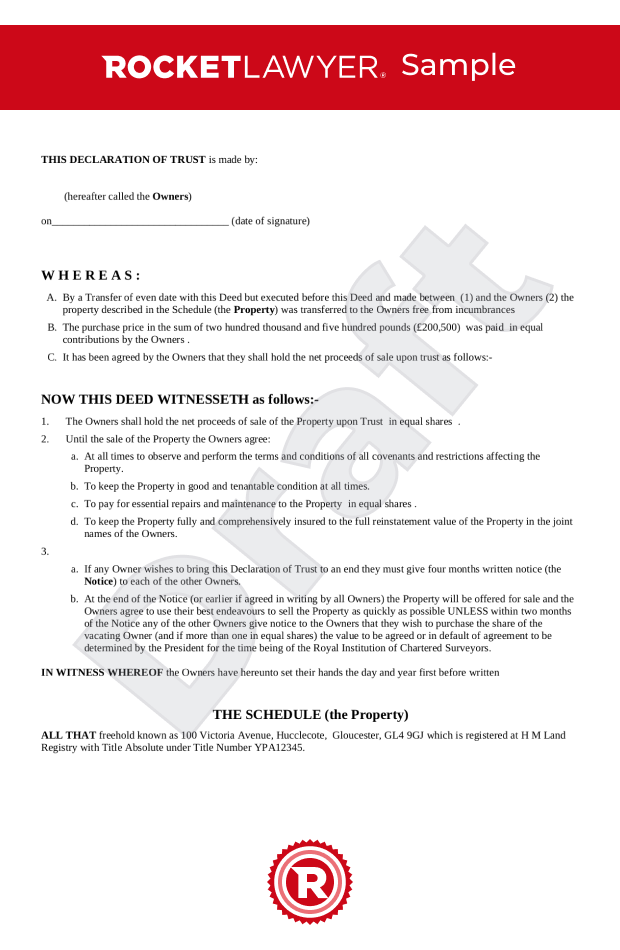

Trust Property Declaration Of Trust Template

DECLARATION OF TRUST Trustee Trust Law

Rental Declaration Form Declaration Form

16 Printable Declaration Of Ownership Sample Forms And Templates

Fillable Online Declaration Of Trust Rental Template. Declaration Of Trust Rental

Declaration Of Trust Gotilo

Declaration of trust Fill out & sign online DocHub

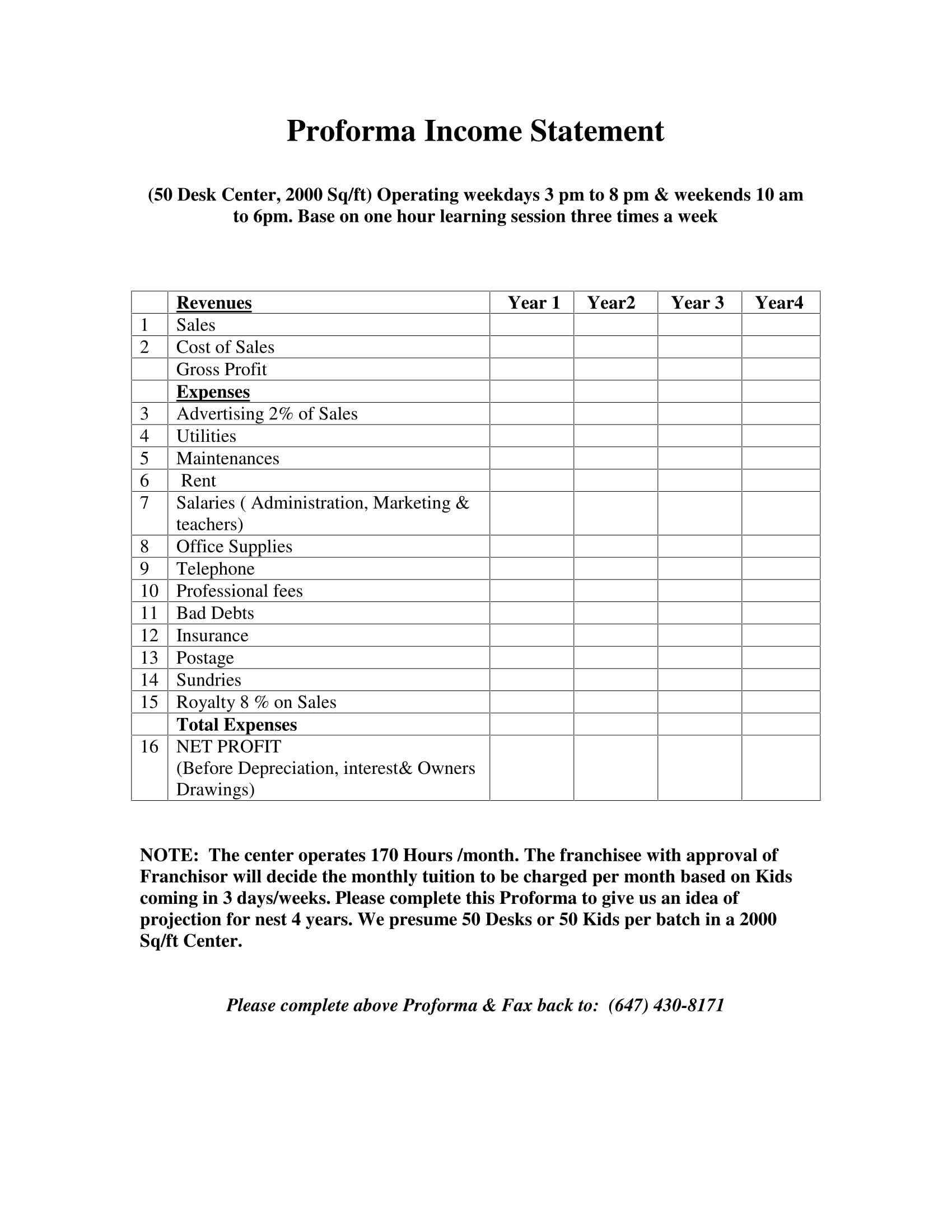

Monthly statement template word polretotal

2. SelfDeclaration of trust by husband and wife or civil partners Trust 2 Declaration of

R185 (Trust Statement Of From Trust. If You Are A Trustee, Use This Form To

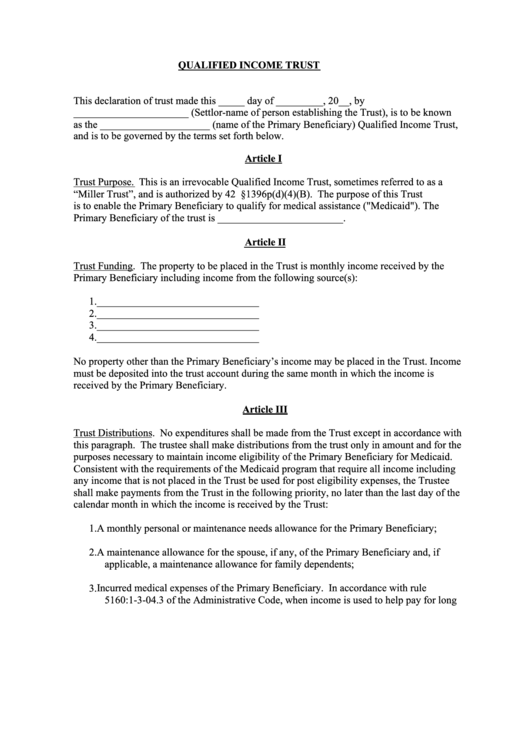

Qualified Trust Declaration Form printable pdf download

Rent Receipt Formats Declaration Form RentalAgreement.in

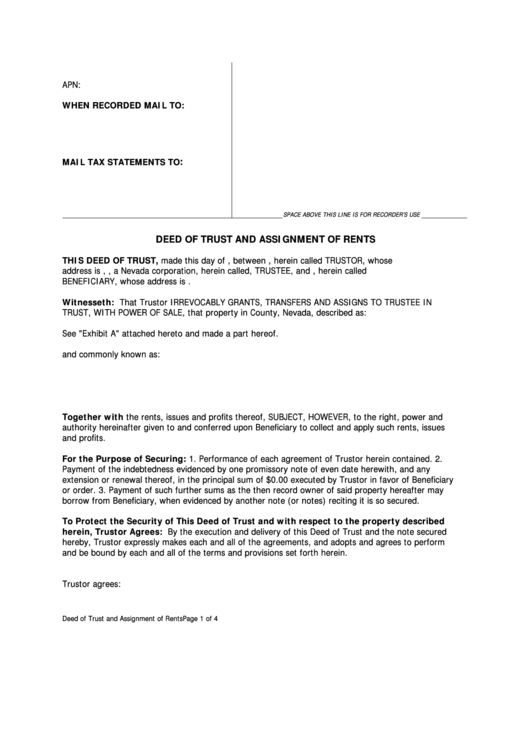

Deed Of Trust And Assignment Of Rents Form printable pdf download

Declaration of Trust (Property) Trust Law Trustee

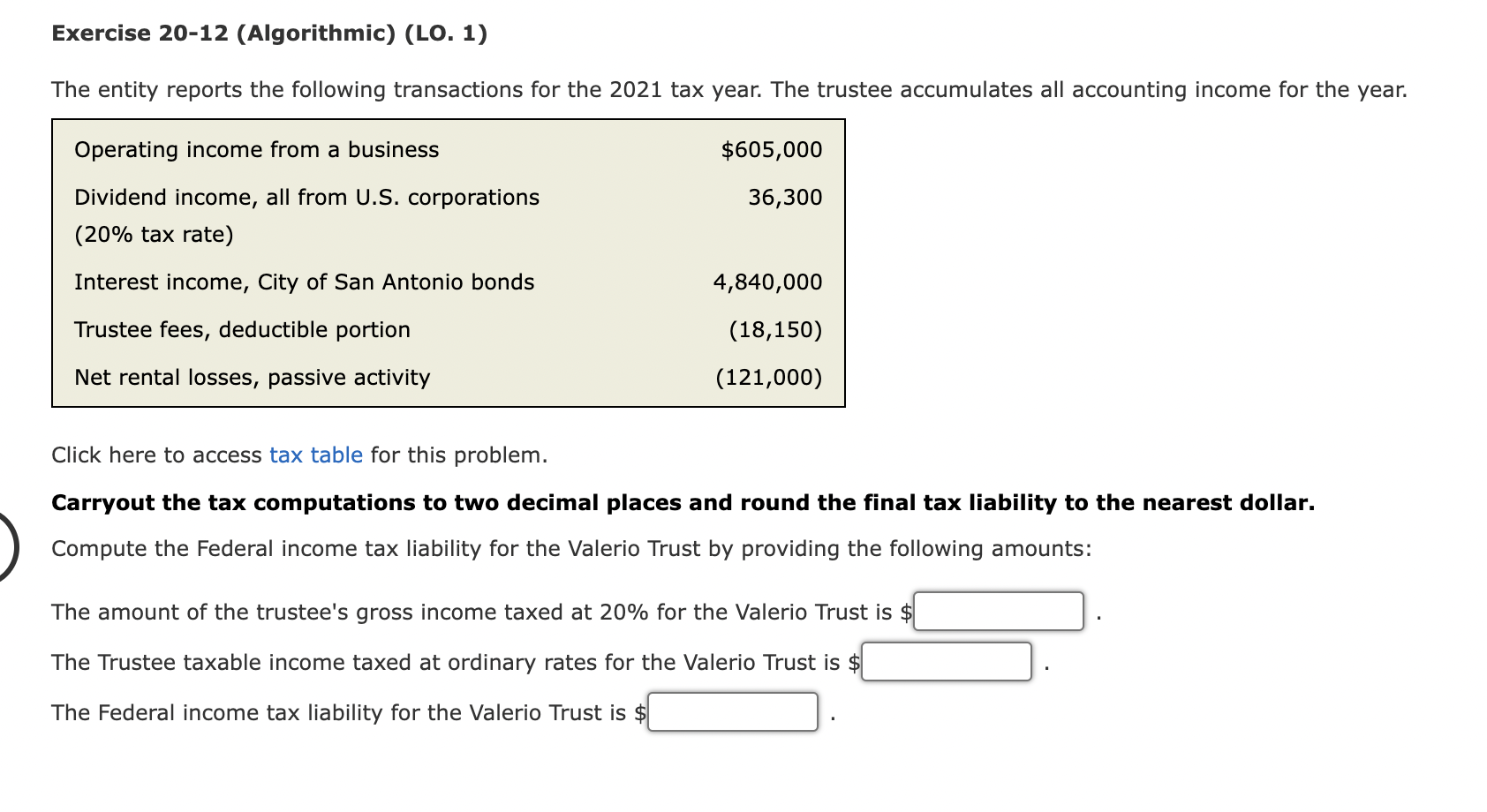

Solved Exercise 2012 (Algorithmic) (LO. 1) The entity

Pin on Letter of Agreement Sample

Trust Declaration with Voting Provisions Legal Forms and Business Templates

Letter Agreement Template

Declaration of Trust Beneficial Interest document template The Legal Stop

Declaration of Trust Do it Yourself or Not. My husband and I own a house which we rent out (no mortgage). I am going to be made redundant from my job soon so it would be beneficial if I could claim the rent as my income. My husband is a 40% tax payer so it would be better for me to complete the self assessment as I won't earn enough to pay any.. I currently receive all the rental income which will be taxed at 40%. It has been suggested that I can set up a declaration of trust, sharing the beneficial right to the rental income with my wife on a 50:50 basis, meaning 50% of the rental income would be taxed at her basic rate which is clearly more tax efficient.